Know the benefits of regular investing

Focusing on the long term can pay off for investors. Whether the goal is saving for a house, college, retirement or a legacy, making a long-range plan—and sticking to it—are important parts of an investment strategy.

Yes, flexibility has its place. For example, investors who take the time to review their goals and strategy at regular intervals can make deliberate adjustments based on changing circumstances. But sudden changes based on an emotional response to news reports may not be the best course.

When the market turns lower, sticking to a long-range plan can be a challenge to even the most seasoned investor. By arming themselves with information, though, investors may be better equipped to ride out tough markets, and even benefit from them.

Dollar-Cost Averaging

Regular contributors to a retirement plan already use a strategy called dollar-cost averaging, many without even realizing it. Dollar-cost averaging simply means investing a fixed amount regularly, regardless of market conditions.

Here’s how it works: Mutual funds are priced using share values. Investors buying shares of a mutual fund become partial owners of the fund. As contributions go into the fund each week or each pay period, more shares of the fund (full or partial, depending on the amount contributed) are purchased. If the market remained constant, the same weekly contribution would always buy the same number of shares. But the market keeps moving, and dollar-cost averaging takes advantage of those ups and downs. In a down market, each share costs less, so the number of shares grows faster if the contribution amount stays the same.

The shares accumulate more slowly in an up market, when the price per share is higher. Over the long term, the share price tends to level out.

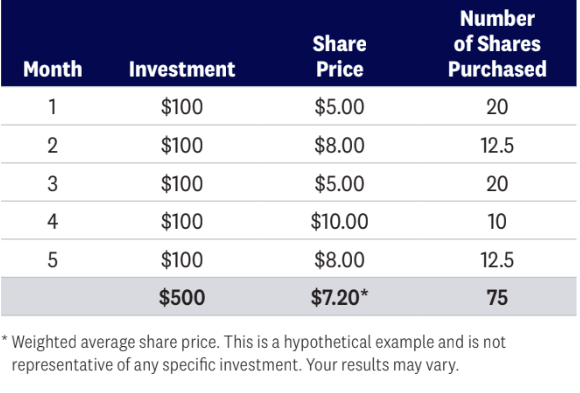

The concept of dollar-cost averaging is shown in the chart below. By investing $100 a month for five months, based on the illustration below, as the price per share and number of shares purchased fluctuates, $500 purchases 75 shares at an average share price of $7.20.

While the goal of dollar-cost averaging is to lower the investor’s average portfolio cost, it does not ensure a profit or protect against loss.

Taking Advantage of Market Movements

During periods of extreme market fluctuations, dollar-cost averaging investors may have more return potential. The more frequently the market dips, the more opportunities there are to buy at lower prices. In this way, the investor’s account can accumulate many more shares of the fund that may benefit from future up markets. Making regular contributions is one important factor in successful long-term investing. You should consider your ability to continue purchasing through fluctuating price levels. By making a plan, sticking to it, and taking advantage of dollar-cost averaging, investors are following a widely used strategy to work toward their investment goals.

Wherever your retirement goals take you, we can help you on your journey.

|

*Dollar cost averaging involves continuous investment in securities regardless of fluctuation in price levels of such securities. An investor should consider their ability to continue purchasing through fluctuating price levels. Such a plan does not assure a profit and does not protect against loss in declining markets. |